This

course is the continuation of Intermediate Accounting Part I. It is designed to

cover the financial accounting principles relative to recognition, measurement,

valuation and presentation of liabilities and shareholders’ equity, including

disclosure requirements. The related internal control, ethical issues and

management of liabilities and owner(s)’ equity are also covered. It also deals

with contemporary issues such as leases, employees’ retirement benefits

deferred taxes, and other current related items. This subject also deals with

the presentation of financial statements that conforms to the latest Philippine

Financial Reporting Standards, for a corporate type of business.

- Teacher: Senador V. De la Cruz

This course analyses Philippine history from multiple perspective through the lens of selected primary sources coming from various disciplines and of different genres. Students are given opportunities to analyse the author’s background and main arguments, compare different points of view, identify biases and examine the evidences presented in the document. The discussions will tackle traditional topics in history and other interdisciplinary themes that will deepen and broaden their understanding of Philippine political, economic, cultural, social, scientific and religious history. Priority is given to primary materials that could help students develop their analytical and communication skills. The end goal is to develop the historical and critical consciousness of the students so that they will become versatile, articulate, broad-minded, morally upright and responsible citizens.

This course includes mandatory topics on the Philippine Constitution, Agrarian Reform, and Taxation.

- Teacher: Maxima Sanchez

- Teacher: Mary Paz Abad

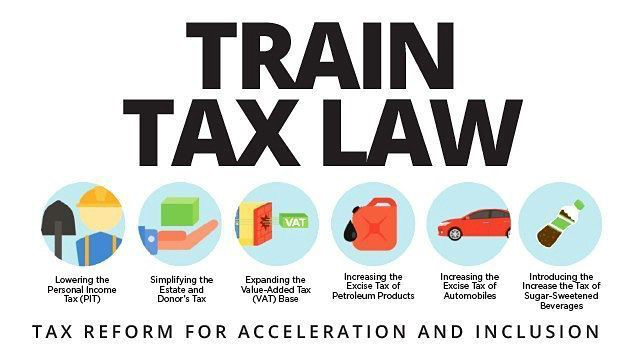

The course is an introduction to taxation and

income tax course and is principally a study of the basic principles of

Taxation, Income Taxation, Estate and Donor’s taxes and the different business

and transfer taxes imposed under the National Internal Revenue Code (NIRC). The

first part is aimed at situating Taxation as a law in the context of the Philippines

legal system and introduces the student concept of Taxation and its

significance as a State Power. It also seeks to thoroughly acquaint the

students with the general principles of Taxation. The second part is primarily

devoted to the study of the concept of Income and Income Taxation, business

taxes specifically, Value Added Tax (VAT), as well as other business taxes

namely: excise taxes, other percentage taxes, documentary stamp taxes, and

community tax certificate. It emphasizes the social and moral responsibility of

the people to pay the taxes in support of the government and to enhance human

development and social transformation.

- Teacher: Mary Paz Abad